child tax credit portal update dependents

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. To apply applicants should visit.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit.

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

. The IRS will pay 3600 per child to parents of young children up to age five. Half of the money will come as six monthly payments and half as a 2021 tax credit. The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. Click the blue Manage. You must meet certain income thresholds.

COVID Tax Tip 2021-167 November 10 2021. Single or married and filing separately. Visit ChildTaxCreditgov for details.

932 ET Jul 6 2021. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit. Visit the IRS website to access the Child Tax Credit Update Portal.

Heres how they help parents with eligible dependents. Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax. The Child Tax Credit Update Portal allows people to unenroll from.

In 2022 they will file their 2021 return report the. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. E-File Directly to the IRS.

The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit. The IRS will add more features.

Child tax credit portal update dependents. O Check if youre enrolled to receive advance payments o Unenroll from advance payments of the Child Tax Credit o Update or provide. Child tax credit portal update dependents Thursday September 1 2022 Edit.

THE IRS has launched child tax credit online portals that will help parents to get the extra stimulus money when the monthly 300 payments begin. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased. Use the IRSs Child Tax Credit Update Portal to.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back A Business Checklist For Tax. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Filed a 2019 or 2020 tax return and.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account.

Get Help maximize your income tax credit so you keep more of your hard earned money. Ad Home of the Free Federal Tax Return. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov.

You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age or younger. Have been a US. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old.

Ad Tips Services To Get More Back From Income Tax Credit.

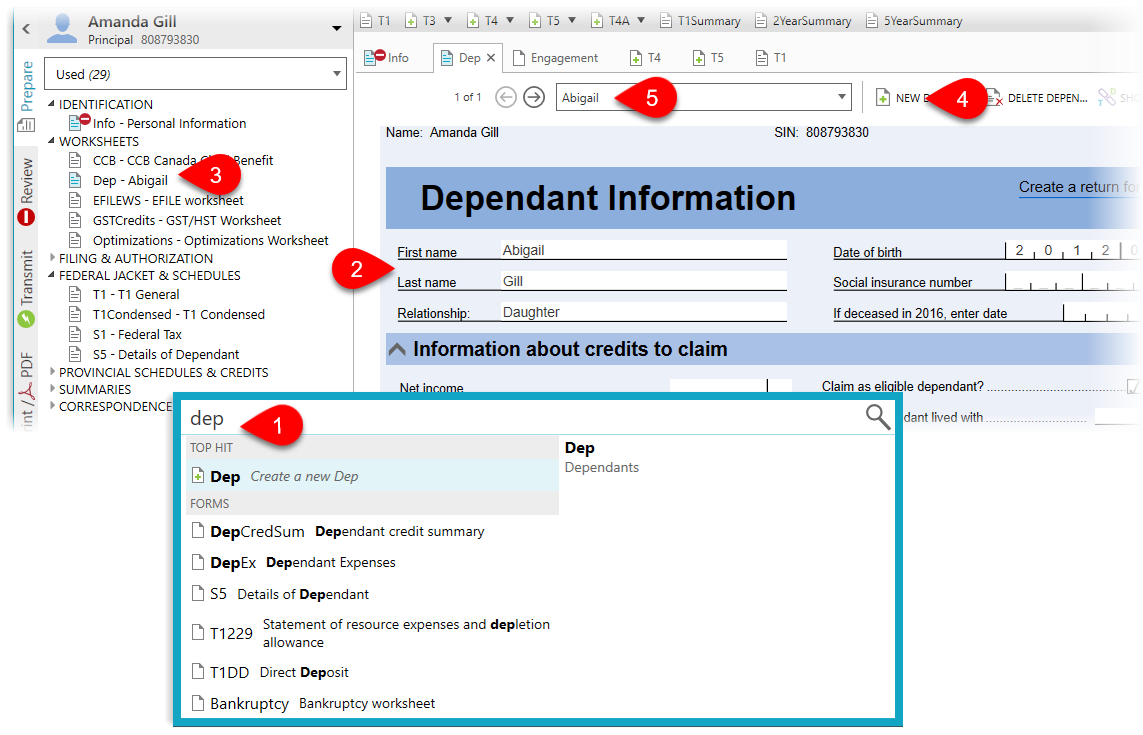

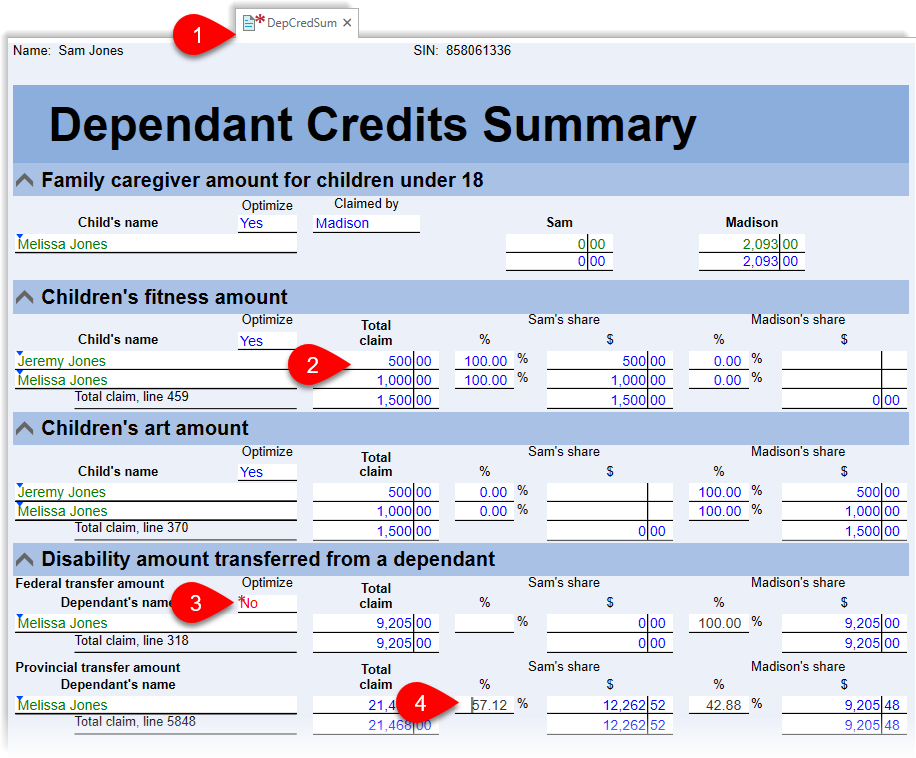

Dependant Tax Credits Dep Depex Depcredsum Taxcycle

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Ready To Use Child Tax Credit Calculator 2021 Msofficegeek

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

A Business Checklist For Tax Filing Accounting Plus Financial Services

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Dependant Tax Credits Dep Depex Depcredsum Taxcycle

How To Get The Advance Child Tax Kandit News Group Facebook

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back